Companies spend a lot of time ensuring that the third party database they choose for the checking of PEPs, Sanctions, and Adverse Media has the right credentials, approvals, and also the right data for the type of subjects that they handle. Time is spent in ensuring that the data provider you choose is going to return the least amount of false positives possible so that your team does not spend a lot of time combing through a lot of false positives. Some companies also consider having multiple data providers to be able to have the peace of mind that their subjects are screened properly. But almost all companies look at the cost of the third party as it is obviously something that impacts the bottom line of the business.

Apart from all of the above, however, the most costly aspect of such a process is often overlooked.

- The fact that your team has to use multiple systems to be able to conduct such searches and set the decision of the matches, leads to wasted time switching between systems, exporting data, marking decisions in one system and also in other internal systems and re-keying the data of subjects manually into separate interfaces.

- The waiting time of having to press SEARCH and then wait for the results to be shown. No matter how quick the response of the provider is, this multiplied by all the subjects that your team needs to conduct the search on, leads to increased costs.

Even worse is the common statistic that almost 60% of all the subjects your team searches, will have no matches (false positives). This, however, cannot reduce your workload as technically speaking you still need to search all of your subjects and prove (by keeping an audit) that there are no matches. And this part of the process is more costly than the process of validating false positives which is also costly in its own right.

This is how the automation processes of KYC Portal helps companies in reducing costs and risk exposure. KYC Portal allows the company to choose any third party they want to integrate into the system, or even opt for multiple third parties hooked up, to have the system check against multiple sources even based on rules.

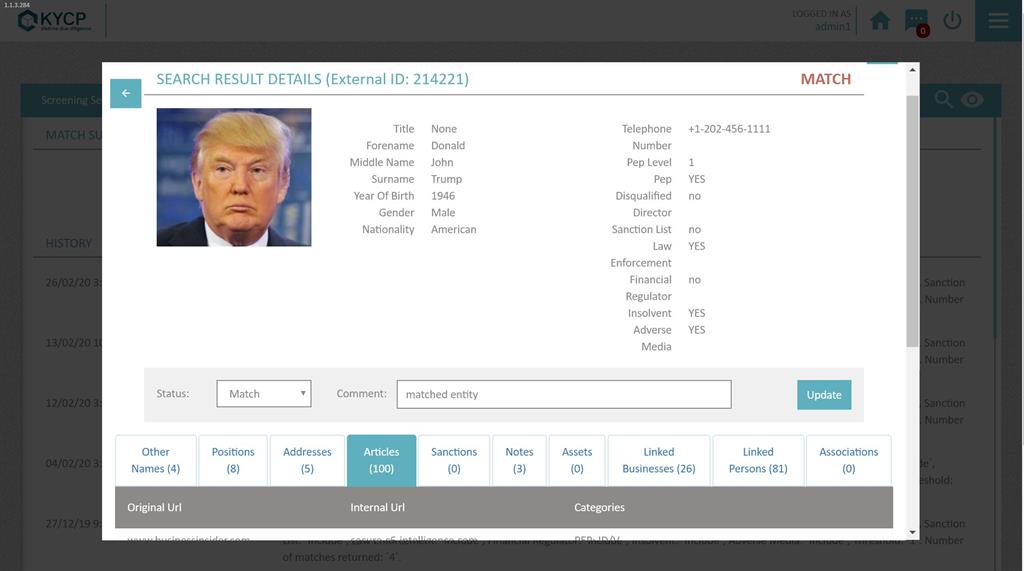

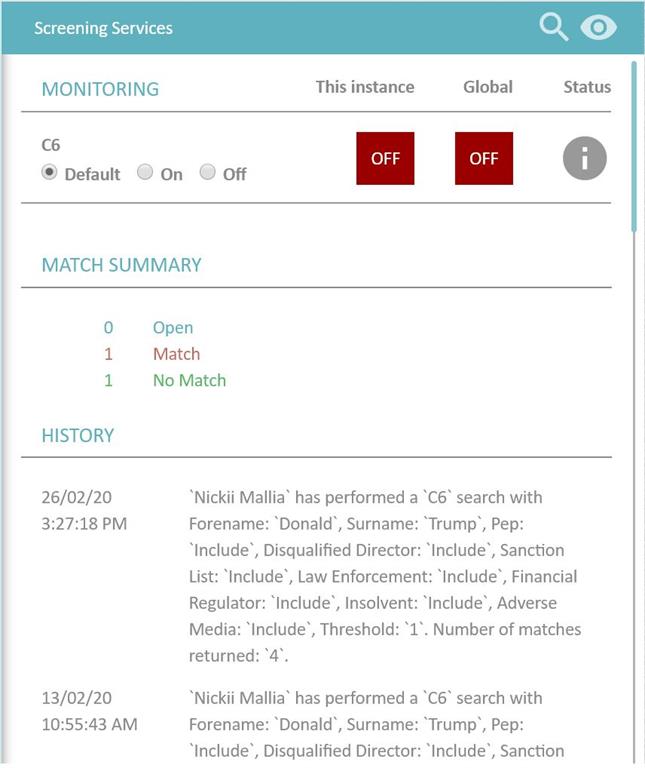

Once integrated, KYC Portal then allows the team to be able to use one system for all the processes of due diligence, compared to having to use various interfaces. This allows the users to be able to run manual searches on subjects and see the results in real-time within KYCP. The data is all presented to the user within KYCP, allowing your team to set decisions (with comments) on false positives. All of these actions, including what was searched, what data was used for the search, the user and timestamp are added to the audit of each subject in the system itself. This is a very important feature for regulatory processes in which such audits become a necessity.

KYC Portal also allows you to hook up the ongoing monitoring on a regular basis on the subjects of choice, if provided by the third party of your choice and the system will notify your team should something crop up that needs to be looked at.

Centralising the searches decisions on unique subjects

Another advantage of hooking up your third party data provider with KYCP is the ability to streamline all actions and decisions on unique subjects across all of your services. If you have a subject (example an individual called John Smith) who is involved in multiple applications across multiple channels (example, he is a Director of one company, also a Shareholder under a different structure but also a direct Client under another service), KYCP centralises the automated checks and monitoring on third party data providers across all involvement. Whilst the action of searching is done once, the audit of the results are stored against all the involvement that this subject has. Even if there are false positives against this subject, your team will only process such matches once and KYCP will store the decision across all the involvement of the subject.

KYC Portal goes beyond the above manual processes by allowing the customer to define how such processes should be automated. One of the features that KYCP allows you to set is what we call “Automatic Search” whereby KYCP will conduct the search automatically. This search will be audited as part of the application and is done as a background process, eliminating the need to have to rely on the human resource to remember to conduct the search and also eliminating all the wasted time waiting for results and then audit the fact that there were no matches. This is done automatically in the system. If there is a match that needs to be looked at by your team then a notification is raised accordingly.

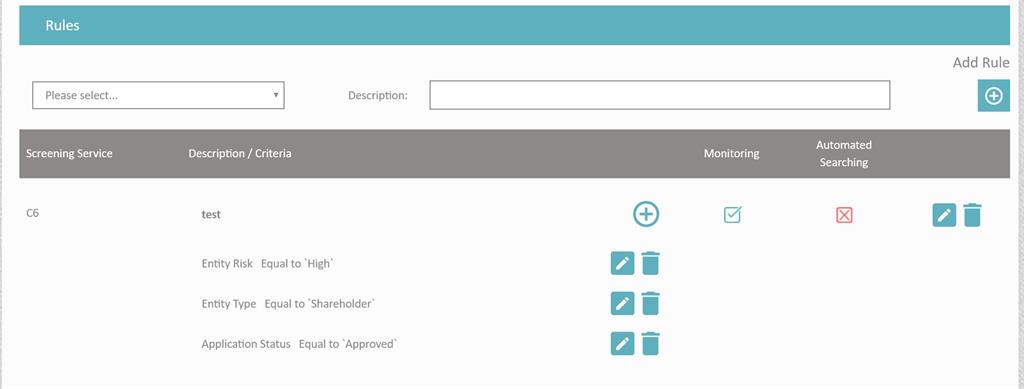

KYC Portal allows you to tweak screening services for maximum cost efficiencies

KYC Portal also allows your management team to decide what should “automatically be searched” or put on “regular monitoring” based on rules that you manage. Rules can be set based on entity types (key principles) – example, you can set that any entity of type SHAREHOLDER should be automatically searched by KYCP whilst any entity of type UBO should be placed on a monitor list.

The automation level also allows to create rules based on criteria such as the following:

- The risk of the entity in question – example, when the DIRECTOR is in a risk bracket of HIGH, put the subject on a monitor. This means that you have the peace of mind that any such type of entity who is high risk is instantly placed on a monitor. It also means that the second that same DIRECTOR has move to a lower bracket of risk, KYCP would have stopped the monitoring service (also stopping any associated costs that you don’t need to pay for with the third party).

- The status or the risk of the application in which the entity is – example, only on applications that are APPROVED with a specific band of risk.

- The value of a field of the entity – example, if the NATIONALITY of the DIRECTOR is Italian and Swedish.

All of the above then hooks with all the other features of KYCP allowing you to automate processes and internal workflows on what should happen with an application when something is flagged. From escalation processes to increased risk, request for additional documentation and also calling internal systems for specific actions to happen.